CUSTOMER

PANEL

Demirler Customs Brokerage

INCOTERMS

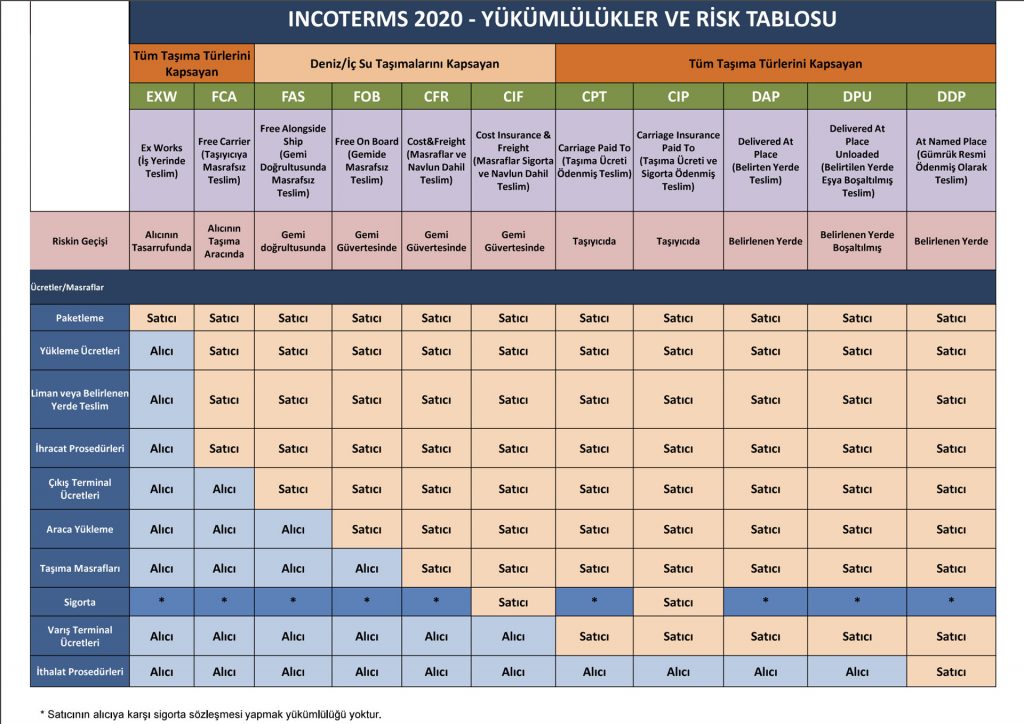

Incoterms are the commercial rules used in international sales contracts of the International Chamber of Commerce (“ICC”). Incoterms are not mandatory rules; they must be explicitly included in their contracts by the parties to achieve legal effect.

Incoterms Classification

Incoterms are divided into four main categories: E, F, C and D.

Category E (Departure), containing only one trade term, ie. EXW (Antiquities).

Category F (Prime Carrier Unpaid), which includes three trade terms:

- FCA(Free Carrier)

- FAS(Free Alongside Ship)

- FOB(Free On Board)

Category C (Toll Major Carriage), which includes four trade terms:

- CPT(Carriage Paid to)

- CIP(Carriage and Insurance Paid to)

- CFR(Cost and Freight)

- CIF(Cost, Insurance and Freight)

Category D (Arrival), includes three trade terms:

- DAP(Delivered at Place)

- DPU (Delivered at Place Unloaded)

- DDP (Delivered Duty Paid)

The four categories mentioned above can also be classified according to the means of transport:

- Incoterms for any mode of transport: EXW, FCA, CPT, CIP, DPU, DAP and DDP

- Incoterms for sea and inland waterway transport only: FAS, FOB, CFR and CIF.

DESCRIPTIONS OF INCOTERMS

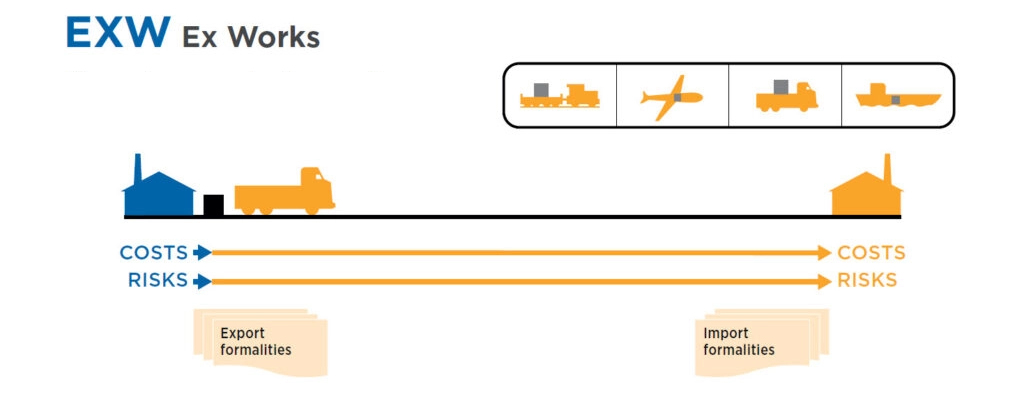

EXW (Ex Works – Delivery at Work)

The term “Delivered at Work” means that the seller delivers the goods at the disposal of the buyer at his own place or at another named place (for example, at the workplace, factory, warehouse, etc.). The seller is not obliged to load the goods on any means of transport, nor is he obliged to fulfill these customs clearance procedures in cases where customs clearance is required for the export of the goods. It is recommended that the parties specify as clearly as possible the relevant point at the designated place of delivery. Because up to this point, the risk of damage and costs belong to the seller. The buyer, on the other hand, bears all the costs and risks of receiving the goods at the designated place of delivery, from the agreed point, if any.

EXW represents the minimum obligation for the seller. This term should be used with the following considerations:

- a) The seller has no obligation to the buyer to load the goods, even if in practice the seller is in a more convenient position to load the goods. If the seller loads the goods, he does so at the buyer’s risk and expense. Where the seller is in a better position to load the goods, the FCA rule would be more appropriate, which obliges the seller to load the goods at his own expense and risk.

- b) On EXW basis for export from Seller

The buyer who buys the goods should know that the seller is under the obligation to provide assistance only at the rate that the buyer will demand in order to carry out the export, on the other hand, he is not obliged to fulfill the customs procedures for export. Therefore, it is recommended not to use this rule if the buyer is unable to clear the customs clearance for export, either directly or indirectly.

- c) The buyer’s obligation to inform the seller about the export of the goods is limited. However, the seller may need this information for reasons such as taxation, reporting, etc.

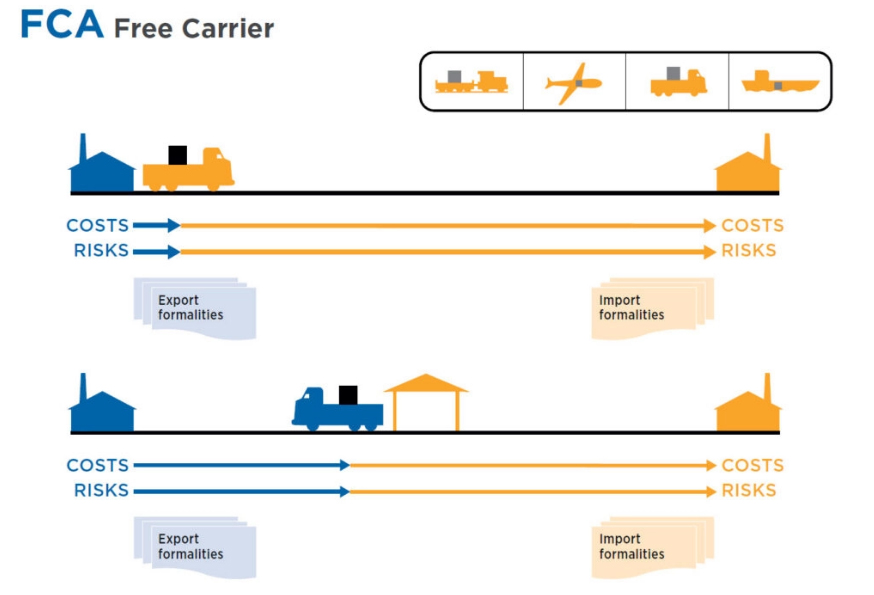

FCA (Free Carrier -No Charge on Carrier)

The “Free Carrier” rule means that the seller delivers the goods to the carrier or another person designated by the buyer at the seller’s premises or other designated place. It is recommended that the parties specify as clearly as possible the relevant point at the designated place of delivery. Because at this point, the damage passes to the buyer.

If the parties intend to make the delivery at the seller’s workplace, they must define the address of this workplace as the designated delivery place.

The FCA rule requires the seller to clear the goods for export to the extent applicable. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import.

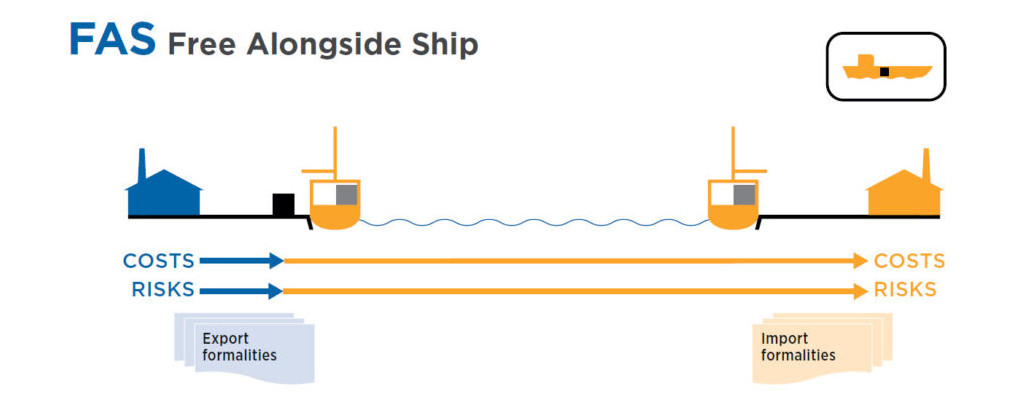

FAS (Free Alongside Ship – No Charge Along Ship)

The “No Charge Along Ship” rule means that the seller delivers the goods at the designated port of shipment, leaving them in line with the vessel chosen by the buyer (for example, on a quay or on a barge). Damage and costs related to the goods pass to the buyer when the goods are left in the direction of the ship, and the buyer bears all costs from that moment on.

It is recommended that the parties specify the loading point at the designated loading port as clearly as possible. Because the costs to be incurred up to this point are borne by the seller and the handling fees related to these costs may vary depending on the application at the port.

The seller must either deliver the goods in line with the ship or procure goods already delivered in this way. Reference to the term “supply” here refers specifically to multiple sales in a chain (series) as is customary in the sale of commodities.

In cases where the goods are in the container, it is usual for the seller to deliver the goods to the carrier at a terminal rather than in the direction of the ship. In such cases, the FAS rule is not appropriate and the FCA rule should be used.

The FAS rule requires the seller to clear the goods for export to the extent applicable. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import.

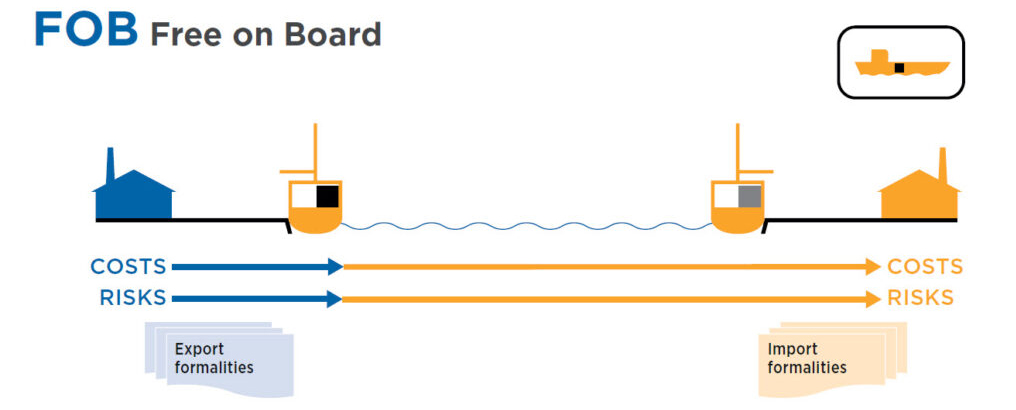

FOB (Free On Board – No Charge on Board)

The “No Charge On Board” rule means that the seller delivers the goods at the named port of shipment, on the vessel chosen by the buyer, or by procuring the goods delivered in this way. Damage and costs to the goods pass to the buyer when the goods are on board, and the buyer bears all costs from that moment on.

The seller must either deliver the goods on board or procure goods already so delivered for dispatch. Reference to the term “supply” here refers specifically to multiple sales in a chain (series) as is customary in the sale of commodities.

The FOB rule may not be suitable where the seller delivers the goods to the carrier at a terminal before they are loaded on the ship. For example, when goods are in containers, it is usual for them to be delivered in this way. In such cases, the FCA rule should be used.

The FOB rule requires the seller to clear the goods for export to the extent applicable. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import.

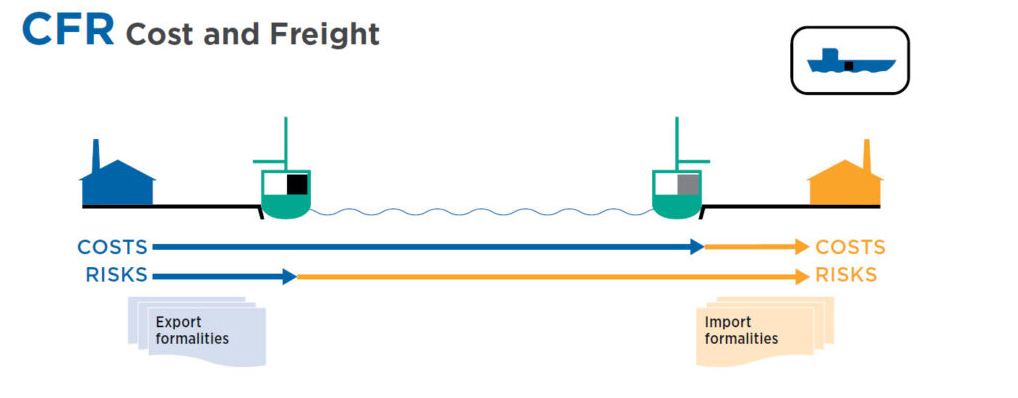

CFR (Cost And Freight)

The “Costs and Freight” rule means that the seller delivers the goods on board or supplies goods already so delivered. Damage and costs to the goods pass to the buyer when the goods are on board. The seller must contract for carriage and pay the costs and freight to bring the goods to the designated port of destination.

Where CPT, CIP, CFR or CIF rules are used, the seller fulfills his obligation to deliver when the goods are delivered to the carrier in accordance with the applicable rule, not when the goods arrive at the place of destination.

This rule has two critical points, because the transfer of damage and the transfer of costs take place in different places. While the contract of sale always specifies a port of destination, it may not specify the port of loading, where loss or damage to the goods passes to the buyer. If the port of loading is particularly important to the buyer, the parties are advised to arrange this as clearly as possible in the contract.

It is recommended that the parties specify as clearly as possible the relevant point at the agreed port of destination. Because the expenses to be incurred up to this point are borne by the seller. It is recommended that the Sancı make a carriage contract that fits this choice. If the seller has to bear the costs of unloading the goods at the port of destination in connection with the contract of carriage, he cannot claim compensation from the buyer for these costs, unless otherwise agreed by the parties.

The seller must either deliver the goods on board or procure goods already so delivered for dispatch to the place of destination. In addition, the seller must either enter into a contract of carriage or procure such a contract. Reference to the term “supply” here refers specifically to multiple sales in a chain (series) as is customary in the sale of commodities.

The CFR rule may not be appropriate where the seller delivers the goods to the carrier at a terminal before they are loaded on the ship. For example, when goods are in containers, it is usual for them to be delivered in this way. In such cases, the CPT rule should be used.

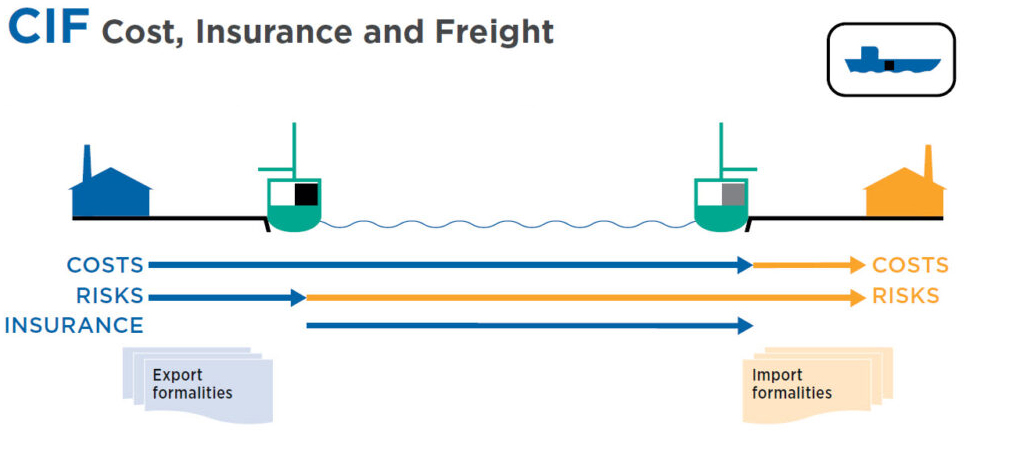

CIF (Cost, Insurence And Freight)

The “Costs, Insurance and Freight” rule means that the seller delivers the goods on board or supplies goods that have already been delivered in this way. Damage and costs to the goods pass to the buyer when the goods are on board. The seller must contract for carriage and pay the costs and freight to bring the goods to the designated port of destination.

The seller also makes an insurance contract against the buyer’s risk of loss and damage to the goods during the journey. The buyer should note that under the CIF rule the seller is only required to obtain insurance that provides minimum coverage. If the buyer wants to be protected with a wider coverage, he should either agree with the seller as clearly as possible or take out additional insurance.

Where CPT, CIP, CFR or CIF rules are used, the seller fulfills his obligation to deliver when the goods are delivered to the carrier in accordance with the applicable rule, not when the goods arrive at the place of destination.

This rule has two critical points, because the transfer of damage and the transfer of costs take place in different places. While the contract of sale always specifies a port of destination, it may not specify the port of loading, where loss or damage to the goods passes to the buyer. If the port of loading is particularly important to the buyer, the parties are advised to arrange this as clearly as possible in the contract.

It is recommended that the parties specify as clearly as possible the relevant point in the port of destination from the decisions. Because the expenses to be incurred up to this point are borne by the seller. The seller is particularly recommended to make a contract of carriage that fits this selection. If the seller has to bear the costs of unloading the goods at the port of destination in connection with the contract of carriage, he cannot claim compensation from the buyer for these costs, unless otherwise agreed by the parties.

The seller must either deliver the goods on board or procure goods already so delivered for dispatch to the place of destination. In addition, the seller must either enter into a contract of carriage or procure such a contract. Reference to the term “supply” here refers specifically to multiple sales in a chain (series) as is customary in the sale of commodities.

The CIF rule may not be suitable where the seller delivers the goods to the carrier at a terminal before they are loaded on the ship. For example, when goods are in containers, it is usual for them to be delivered in this way. In such cases, the CIP rule should be used.

The CIF rule requires the seller to clear the goods for export to the extent applicable. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import.

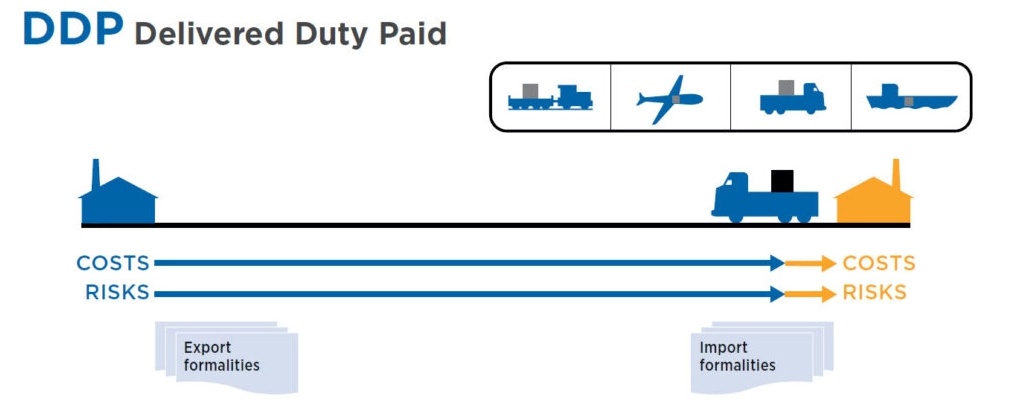

DDP (Delivered Duty Paid)

The “Delivered Duty Paid” rule means that the seller delivers the goods at the disposal of the buyer, cleared for import and ready for unloading on the arriving means of transport at the designated destination. The seller bears all damages and costs related to the delivery of the goods to the designated place of destination and is obliged to carry out customs clearance not only for the export but also for the import of the goods, to pay any fees required for export and import, and to fulfill all customs formalities.

The DDP rule indicates the maximum liability for the seller.

It is recommended that the parties specify as clearly as possible the point of interest at the designated destination. Because the costs and damage to be incurred up to this point are borne by the seller. The seller is particularly recommended to conclude a contract of carriage that fits this selection. If the seller incurs costs for unloading the goods at the place of destination in accordance with the contract of carriage, he cannot claim reimbursement of these costs by the buyer, unless otherwise agreed by the parties.

Parties are advised not to use the DDP rule if the seller is not able to directly or indirectly fulfill the customs clearance procedures required for import.

The DAP rule should be used if the parties want the buyer to bear all the costs and damages of customs clearance of the goods for import.

Unless otherwise expressly agreed in the sales contract, VAT and all other taxes payable on imports belong to the seller.

However, it does not oblige the seller to pay a collateral insurance directly in the form of delivery, but imposes this obligation on the seller or the buyer within the scope of the contract to be made between the seller and the buyer. In this respect, it is necessary to examine whether there is an insurance contract between the buyer and the seller in the transactions subject to the DDP delivery method, where no insurance payment statement is made by the buyer, in terms of the elements to be added to the value.

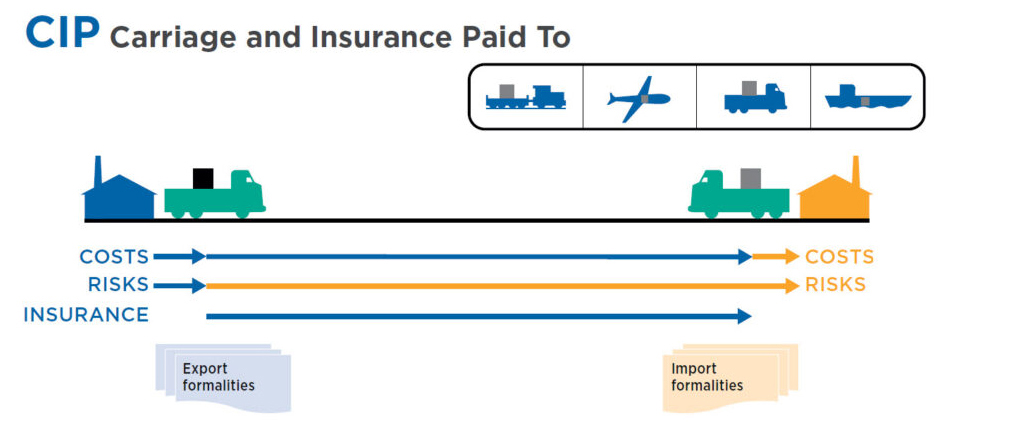

CIP (Carriage and Insurance Paid To…)

The “Carriage and Insurance Paid” rule states that the seller will deliver the goods to a carrier or other person of his choice at the designated place (if such a place is agreed by the parties) and the seller is obliged to enter the contract of carriage and pay the transportation costs, by which the goods must be brought to the named destination. means.

The seller also makes an insurance contract against the buyer’s risk of loss and damage to the goods during the journey. The buyer should note that under the CIP rule the seller is only required to obtain insurance that provides minimum coverage. If the buyer wants to be protected with a wider guarantee, he should either agree with the seller as clearly as possible or take out additional insurance.

Where CPT, CIP, CFR or CIF rules are used, the seller fulfills his obligation to deliver when the goods are delivered to the carrier, not when the goods arrive at their destination.

This rule has two critical points, because the transfer of damage and the transfer of costs take place in different places. It is recommended that the parties arrange as clearly as possible in the contract the place of delivery where the damage will pass to the buyer and the place of destination where the seller will conclude a contract of carriage for the carriage of the goods up to that point. If more than one carrier is used to deliver the goods to the designated destination, the damage is passed to the buyer upon delivery of the goods to the First carrier, that is, at the sole discretion of the seller and over which the buyer has no control. If the parties wish to arrange for the damage to pass at a later stage (for example, at an ocean port or airport), this should be addressed in the contract of sale.

It is recommended that the parties specify as clearly as possible the point of interest at the designated destination. Because the expenses to be incurred up to this point are borne by the seller. The seller is particularly recommended to make contracts of carriage that fit this selection. If the seller has to bear the costs of unloading the goods at the port of destination in connection with the contract of carriage, he cannot claim compensation from the buyer for these costs, unless otherwise agreed by the parties.

The CIP rule, as applicable, requires the seller to clear the goods for export. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import.

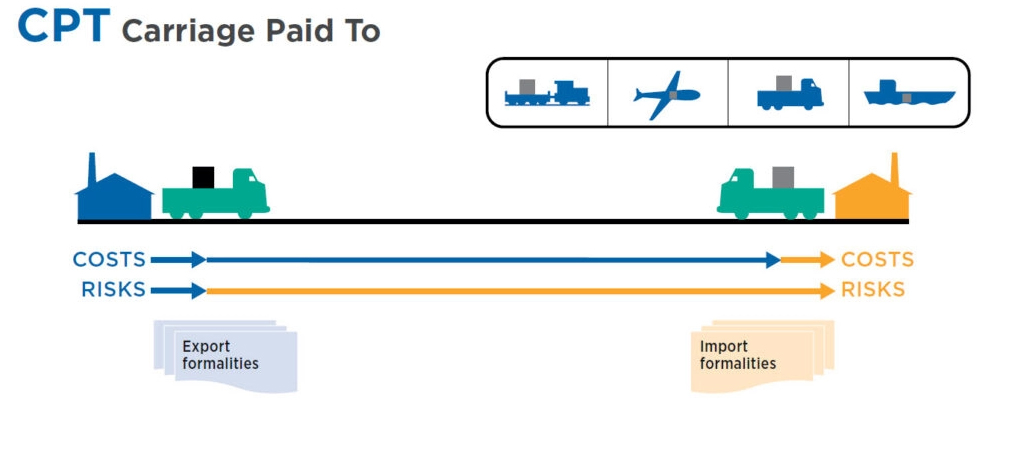

CPT (Carriage Paid To….)

The “Carriage Paid” rule states that the seller will deliver the goods to a carrier or other person of his choice at the designated place (if such a place is agreed by the parties) and that the seller must conclude the contract of carriage and pay the transportation costs necessary to bring the goods to the named destination. it does. Where CPT, CIP, CFR or CIF rules are used, the seller fulfills his obligation to deliver when the goods are delivered to the carrier, not when the goods arrive at their destination.

This rule has two critical points, because the transfer of damage and the transfer of costs take place in different places. It is recommended that the parties specify in the contract as clearly as possible the place of delivery where the damage will pass to the buyer and the place of destination where the seller will enter into a contract of carriage for the carriage of the goods up to that point. If more than one carrier is used to deliver the goods to the designated destination, the damage passes to the buyer when the goods are delivered to the first carrier, that is, at the sole discretion of the seller and over which the buyer has no control. If the parties wish to arrange for the damage to pass at a later stage (for example, at an ocean port or airport), this should be addressed in the contract of sale.

It is recommended that the parties specify as clearly as possible the point of interest at the designated destination. Because the expenses to be incurred up to this point are borne by the seller. It is recommended that the contractor make a contract of carriage that fits this selection. If the seller has to bear the costs of unloading the goods at the port of destination in connection with the contract of carriage, he cannot claim compensation from the buyer for these costs, unless otherwise agreed by the parties.

The CPT rule, as applicable, requires the seller to clear the goods for export. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import.

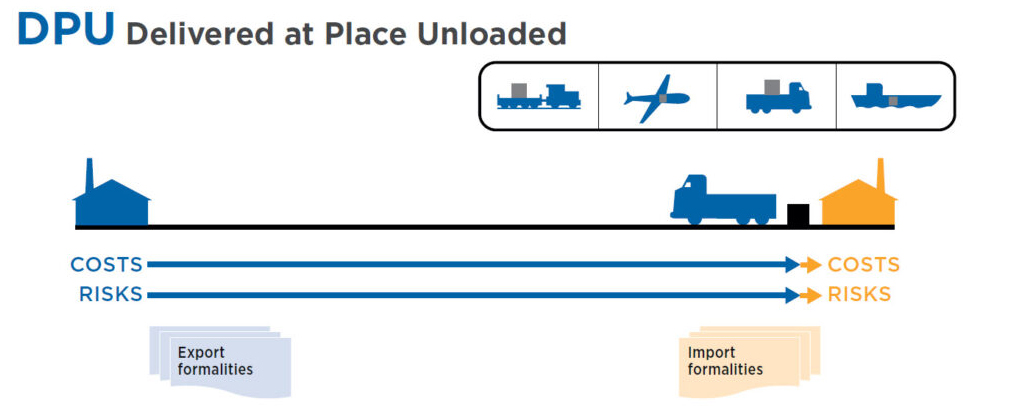

DPU (Delivered at Place Unloaded);

The rule of “Delivered Unloaded at the Designated Place” is included in the section covering all transportation types. It is a form of delivery where the seller has more obligations than the buyer.

Control, packaging, marking, exit customs clearance, licensing, permits, loading, freight and unloading services are the seller’s responsibility.

In this form of delivery, only the transactions and official permissions at the customs office of destination are the responsibility of the buyer.

Insurance liability is the responsibility of whichever party is assumed in the contract of sale. (According to Akit)

When evaluated in terms of customs procedures, DPU is in the form of delivery; It should be noted that the freight cost of the goods arriving in the Customs Territory of Turkey is undertaken by the seller, but the insurance is determined according to the contract. The sales contract can be consulted to clarify who pays for the insurance.

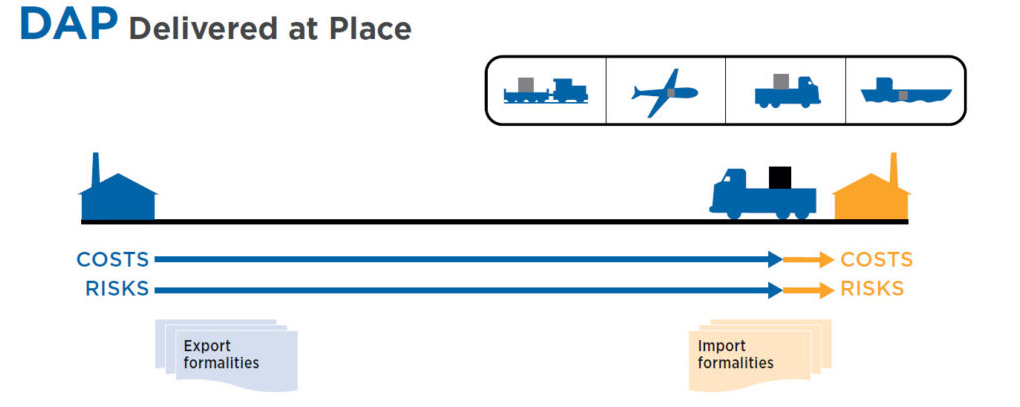

DAP (Delivered At Place)

The “Delivered at the Designated Place” rule means that the seller delivers the goods at the disposal of the buyer without unloading them from the arriving means of transport at the named destination. The seller bears all damages and costs related to the delivery of the goods to the designated destination.

It is recommended that the parties specify as clearly as possible the point of interest at the designated destination. Because the expenses to be incurred up to this point are borne by the seller. The seller is particularly recommended to conclude a contract of carriage that fits this selection. If the seller incurs costs for unloading the goods at the place of destination in accordance with the contract of carriage, he cannot claim reimbursement of these costs by the buyer, unless otherwise agreed by the parties.

The DAP rule requires the seller to clear the goods for export to the extent applicable. However, the seller has no obligation to clear the goods for import, pay import duties and follow up on customs formalities required for import. The term DDP should be used if the parties want the seller to clear the goods for import, pay any import duties or fulfill customs formalities.

However, it does not oblige the seller to pay a collateral insurance directly in the form of delivery, but imposes this obligation on the seller or the buyer within the scope of the contract to be made between the seller and the buyer. In this respect, it is necessary to examine whether there is an insurance contract between the buyer and the seller in the transactions subject to the DAP delivery method, for which no insurance payment statement is made by the buyer, in terms of the elements to be added to the value.